am i taxed on stock dividends

Example Of No Withholding Tax. You still need to pay taxes either before or after you contribute the money but you will not have to pay.

How Are Dividends Taxed How Can They Lower Taxes In Retirement Planeasy

However thanks to 15 withholding tax it looks.

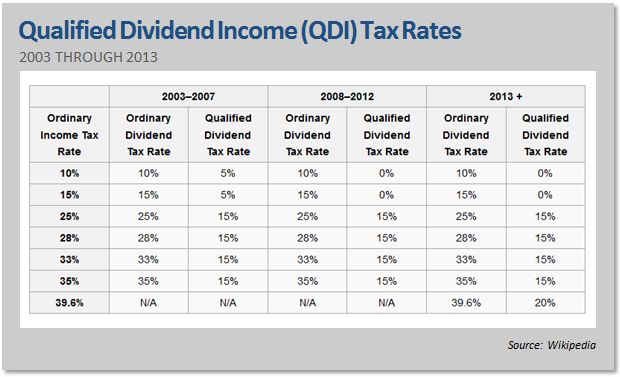

. Learn ways dividends can help generate income in this free retirement investment guide. Under current law qualified dividends are taxed at a 20 15 or 0 rate. Ad Have a 500000 portfolio.

Unless you buy and hold your stocks in an IRA. If you hold stock securities. And it is closely related to reason 2.

Which is a great idea by the way. Non-qualified or ordinary dividends which include most dividends paid to shareholders are taxed at short-term capital gains. 1 day agoThe recent announcement comes two years after a five-for-one split was announced in August 2020.

Ad With Best-in-Class Trading Tools No Hidden Fees Trading Anywhere Else Would be Settling. Qualified dividends are dividends that meet the requirements to be taxed as capital gains. Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company.

In the 37 tax bracket your qualified dividends are taxed at 20. Have The Desire To Maximize Tax Efficiency. The tax rate on qualified dividends is 0 15 or 20 depending on your taxable income and filing status.

If you own stocks through mutual funds or ETFs exchange-traded funds the company will pay the dividend to the fund and it will then be passed on to you through a fund dividend. My current thoughts are to move over a couple of the bigger US dividend-paying stocks to the SIPP such as ATT. This is usually lower than the rate for nonqualified dividends.

If you sold the stock for more than you bought it you may owe a capital gains tax. Dividend Tax Rates for the 2022 Tax Year. Currently they pay 052 per share per quarter equating to 5824 or 4215 at the current exchange rate.

If you netted a capital loss you might be able to use the loss to reduce your income for the year. Qualified Dividend Tax Benefits. Ad Ex-Dividend Dates Dividend Calendar All-Star Rankings Special Divs More.

Long-term rates are lower with a cap of 20 percent in 2019. Qualified dividends are taxed differently than normal dividends. The benefit of retirement accounts is that your money grows tax-free until retirement.

As an example I currently have 112 shares of ATT ticker symbol T. Because dividends are taxable if you buy shares of a stock or a fund right before a dividend. Nyse Nasdaq Amex Otcbb Dividend Tracker.

Dividends are payments of income from companies in which you own stock. Download The Definitive Guide to Retirement Income. The former is taxed at the capital gains rate.

Generally any dividend that is paid out from a common or preferred stock is an ordinary dividend unless otherwise stated. So lets look at the 2021 tax brackets for single and joint filers of qualified dividends. If your income is lower than 39375 or 78750 for married couples youll pay zero in capital gains taxes.

Unqualified dividends are taxed at your ordinary income tax rate the same rate that applies to your wages or self-employment income. More likely than not you will pay taxes on your dividends. You might also carry the loss forward to the next tax year to offset any capital gain you may make then.

Dividends are distributions of property a corporation may pay you if you own stock in that corporation. Ordinary dividends are taxed as ordinary income. You generally pay taxes on stock gains in value when you sell the stock.

So if you fall into the 32 tax bracket youll pay a 32. Selling stocks will have consequences for your tax bill. Or qualifying foreign companies whose stock youve held for at least 61 days of a 121-day holding period.

If your income is between 39376 to 434550 youll pay 15 percent in capital gains taxes. The best way to avoid taxes on dividends is to put dividend-earning stocks in a pre-tax retirement account. And if your income is 434551 or more your capital gains tax rate is 20.

Qualified dividends come from investments in US. Especially if you open your IRA at Webull. In both cases people in.

Qualified dividends are taxed at capital gain rates of 0 15 or 20 depending on your tax bracket. In the 10 or 12 tax bracket your qualified dividends are taxed at 0 In the 22 24 32 or 35 tax bracket your qualified dividends are taxed at 15 and. You also may receive distributions through your interest in a partnership an.

For buying and selling your stocks for free. Qualified dividends are taxed at long-term capital gains rates. However they may also pay them as stock of another corporation or as any other property.

Corporations pay most dividends in cash. For single filers you pay a 0 capital gains rate for up to 40400. During that time the companys stock was trading at nearly 1300 a share and the stock-split.

If a stock pays dividends you generally must pay taxes on the dividends as you receive them. Answer Simple Questions About Your Life And We Do The Rest.

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

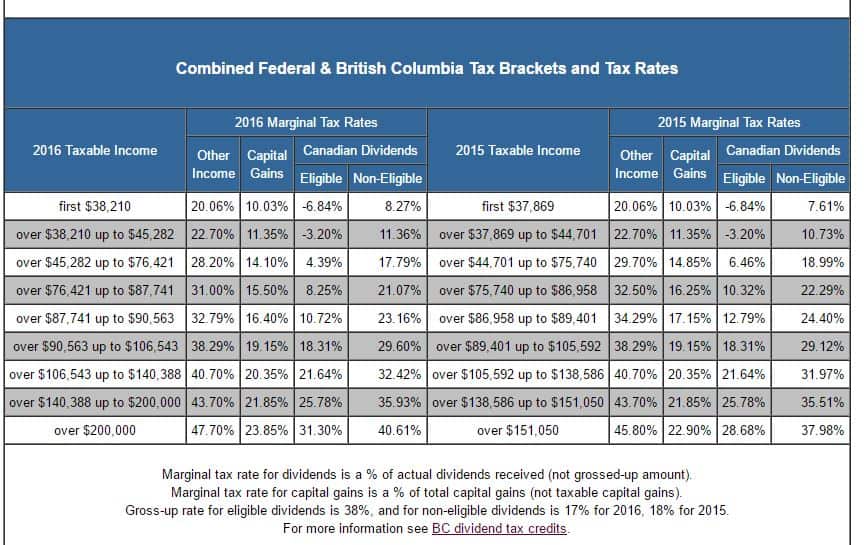

How The Dividend Tax Credit Works

/DividendCaptureStrategy2-ed2bf3eddb4f4d56acf17a43a78ee358.png)

If I Reinvest My Dividends Are They Still Taxable

/1099-DIV-ffc2266fbad34acd9de5359089733572.jpg)

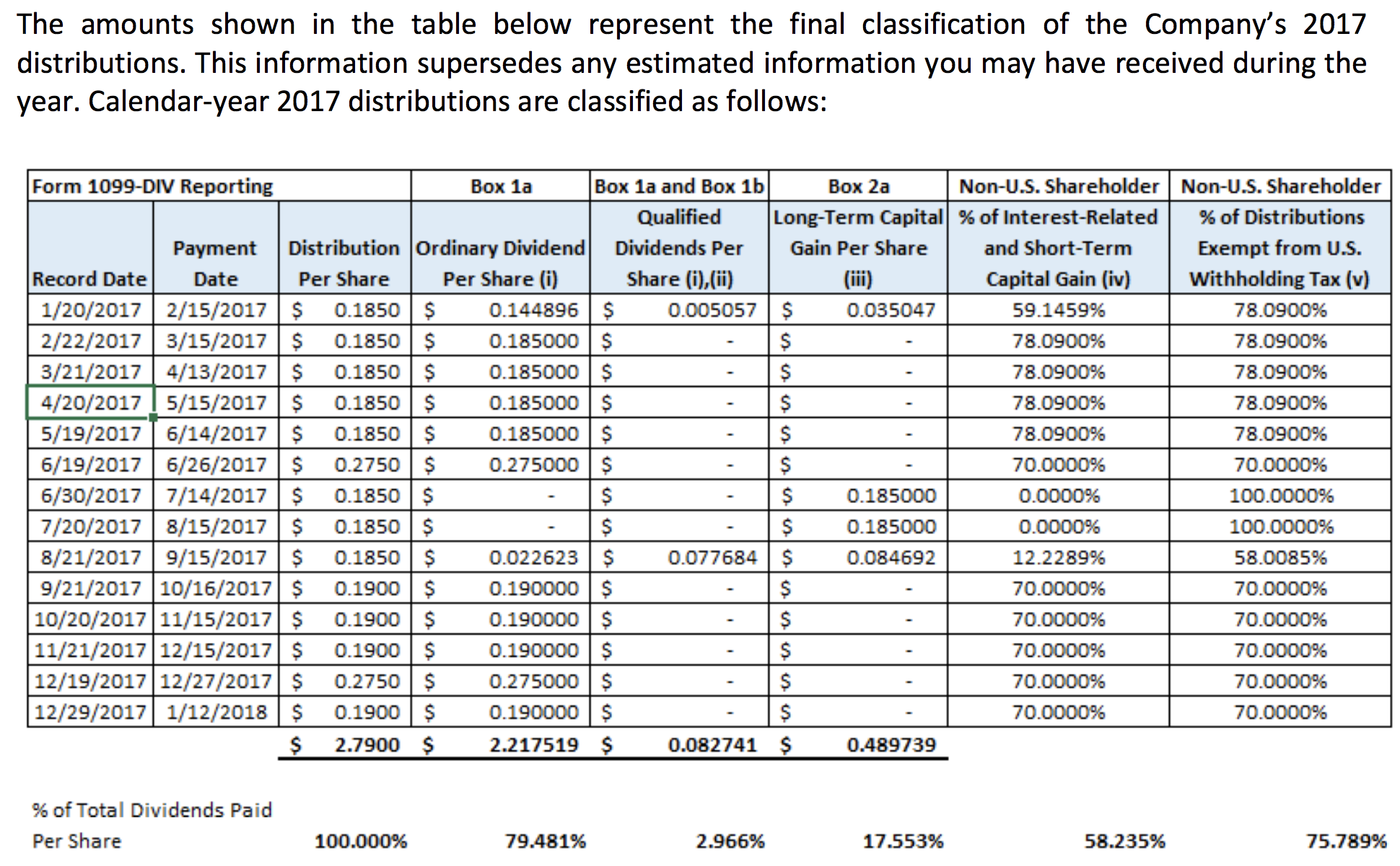

Form 1099 Div Dividends And Distributions Definition

How To Pay No Tax On Your Dividend Income Retire By 40

Why You Re Getting A Tax Break On Dividend Income

Are Lower Tax Preferred Stock Dividends Really A Better Deal Seeking Alpha

What Are Dividend Stocks How Do They Work Nextadvisor With Time

Special Dividend Definition Rules And Impact On Stock Price Intelligent Income By Simply Safe Dividends

Dividend Income Taxable From Fy21 How Much Tax Do You Have To Pay Youtube

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

Where Should I Keep My Dividend Stocks Tawcan

Guide To Taxes On Dividends Intelligent Income By Simply Safe Dividends

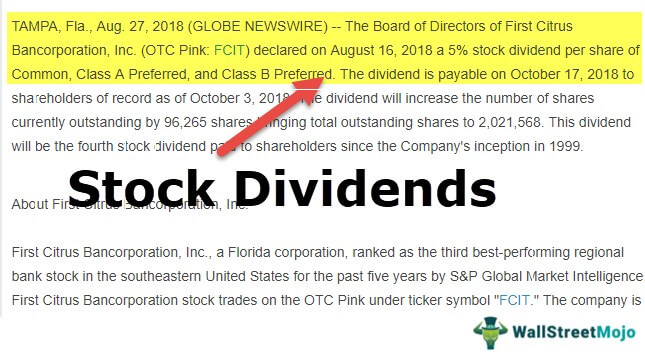

Stock Dividend Meaning Payout Calculation Journal Entry

:max_bytes(150000):strip_icc()/DividendCaptureStrategy2-ed2bf3eddb4f4d56acf17a43a78ee358.png)

If I Reinvest My Dividends Are They Still Taxable

How Are Dividends Taxed How Can They Lower Taxes In Retirement Planeasy

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Tax Implications Of A Dividend H R Block

Guide To Taxes On Dividends Intelligent Income By Simply Safe Dividends